Often, contact centre advisors develop habits that may seem harmless but rile customers. Here Andrew Moorhouse provides key four examples.

1. Evasion

We often hear great stories about advisors going the extra mile for the customer, but sometimes an advisor may do the opposite and ignore the best interests of the customer to bring the call to a hasty end.

This could happen for a range of reasons, for example when an advisor is in a bad mood or approaching the end of their shift.

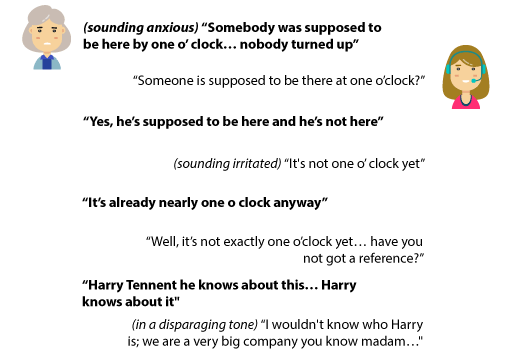

When in this state of mind, the advisor is also more likely to be condescending to the customer. Take the following situation, based on a genuine contact centre interaction, for example:

Picture this scenario. An elderly customer suffers a burst water pipe just outside her home. It’s a 1960s semi-detached property with a small front garden. The leak seems quite severe, bubbling 18 inches into the air. The water is mostly flowing into the street, but it has by now covered her tarmac drive and is lapping at her front doorstep.

The customer has been waiting at home for three hours for someone from the water company to show up. As the water rises, so does her anxiety.

She called initially at 10:00 and was told someone ‘should’ arrive by 13:00 to resolve the problem. When the water covers the first of two steps to her front door, she calls again to see why there is such a delay. The time is 12:51.

Here is the conversation that transpires.

You can almost picture the call hander rolling her eyes as she says: ‘we are a very big company’. Of course, customers often don’t provide the required information in a precise or concise manner, especially when under stress. But that’s no excuse for an exchange like this.

It’s virtually impossible to find the best resolution to a situation when the advisor is being evasive. Understandably, this call didn’t end with a positive Customer Satisfaction (CSat) score.

Another example of this would be when an advisor makes a statement like “it’s company policy”. This statement signals that the advisor just wants to hang up on the customer, but, in truth, company policies are highly unlikely to intrude upon basic customer expectations.

So an advisor should avoid making these statements and instead say what they can do to go the extra mile for the customer and boost their satisfaction.

To find examples of similar phrases, read our article: 11 Things a Call Centre Agent Should Never Say (But Many Do)

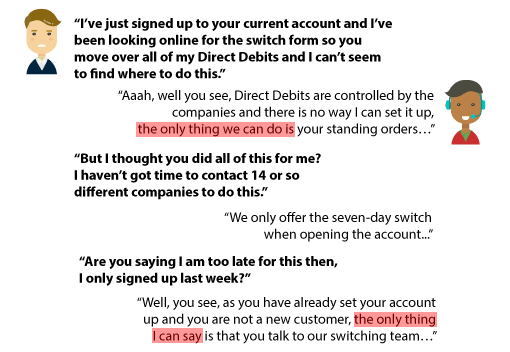

2. Inflexibility

That phrase is: “The only thing I can do is…” And it drives customers insane.

Customers like to be given choices; they do not like being forced down one route, and they expect to be offered support when they phone the contact centre.

In fact, research from Blue Sky found that there is one phrase that seems to be hard-wired into the DNA of lowest-performing call handlers in terms of customer satisfaction.

That phrase is: “The only thing I can do is…” And it drives customers insane.

This statement demonstrates an insistence on sticking to the process rather than thinking about the customer’s unique needs.

Here’s an example of such inflexibility, taken from a high-street bank.

One day, the bank received a phone call from a £100,000-per-year priority customer trying to make a simple direct debit switchover, so that his new current account becomes the main place for all his bills and direct debits. This is how the interaction turned out:

To be fair, it did later transpire that the call handler was only five weeks out of induction and didn’t sufficiently know all the rules, processes and systems. Although this does raise the question why she was allocated to look after the “mass affluent” customer portfolio.

Inflexibility Is Not a Problem Only in Financial Contact Centres

Phrases such as “the only thing I can do is…” are not just used by advisors in banks. In fact it is in issue that affects many contact centres. Consider an Irish supermarket customer, for example, who buys a leg of lamb, only to find it is out of date when he gets home:

Inflexibility is created through an imperfect mixture of a negative mindset (I must follow the process), a poor level of empowerment from the line manager (lack of permission to do the right thing for the customer) and an inability (or lack of desire) to understand the customer’s desired outcome.

Empathy alone isn’t sufficient here. This issue runs much deeper and manifests itself as a complete lack of accountability and ownership.

“The only thing we can do…” has become the new mantra for disillusioned and disempowered contact centre workers across the globe.

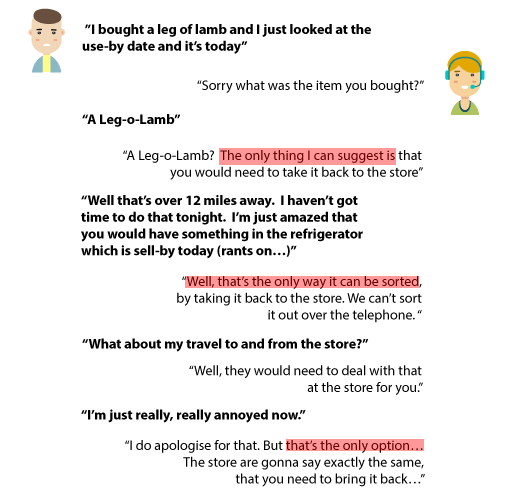

3. Vagueness

Being vague about things like timescales isn’t as headline-catching as evasion or inflexibility, but it causes huge frustration in customer conversations.

A lack of timescales is often accompanied by the presence of certain distinctly ‘fuzzy’ words, which really can get under the skin of a customer.

Observations from Blue Sky have found that many advisors fall into this trap. Their research shows that in only 57% of relevant calls within the industry as a whole does a contact centre advisor clearly set out the next steps in resolving a query.

A lack of timescales is often accompanied by the presence of certain distinctly ‘fuzzy’ words, which really can get under the skin of a customer, who would like to organise their schedule.

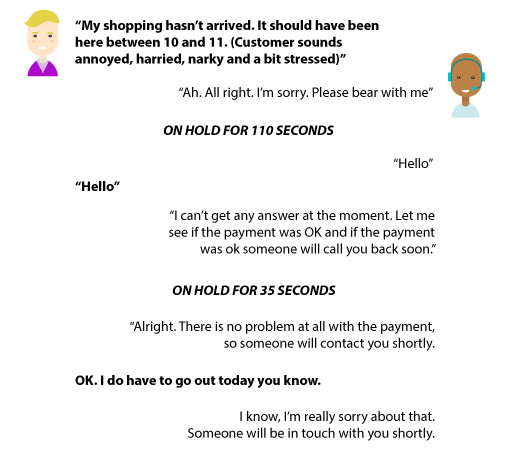

Consider this real-life example from a customer who finds her home shopping hasn’t been delivered:

This interaction demonstrates lack of effective acknowledgement and ownership, as well as a failure to do any effective signposting while the customer is on hold.

But at the core of the customer’s frustration is a lack of clarity on the timescales. How soon is soon? The customer needs to go out! In this example, the customer ends up calling back in 10 minutes for another unsatisfying 10-minute call.

A lack of precision on timescales drives up repeat contacts. In fact, this accounted for 32% of all repeat contacts in one organisation.

Let’s Not Play the Blame Game

Despite the points that were made above, we’re not playing the blame game. The call handlers are probably doing their best.

Instead, it is likely that they may not trust the people further down the line in the process to do their job within the specified time, so their non-committal language is a way to prevent further complaints. Unfortunately, it just leads to a very unsatisfying call.

But what examples are there of advisors being very precise around timescales and reassuring the customer?

Here is an example of an effective statement that an advisor at a FTSE 100 water company used, which included a helpful personal anecdote:

“OK. Right then, sir, that has been raised for you now. The maximum timescale for us to get out to you is five days. These are just maximum timescales. Obviously if he can fix it right there and then, then he will. If he can’t he will have to request that the contractors come out to fix it for you and get that replaced and that’s a maximum of 30 days for them to do this.”

4. Over-Sharing

At first this seems to contradict the importance of avoiding vagueness. But the other extreme, overwhelming the customer with unnecessary detail, is just as strong an irritation for the customer.

Contact centres with a billing function may wish to check that their advisors do not have too great a fondness for numbers, which can be pushed onto customers. This is something academics call ‘the curse of knowledge’.

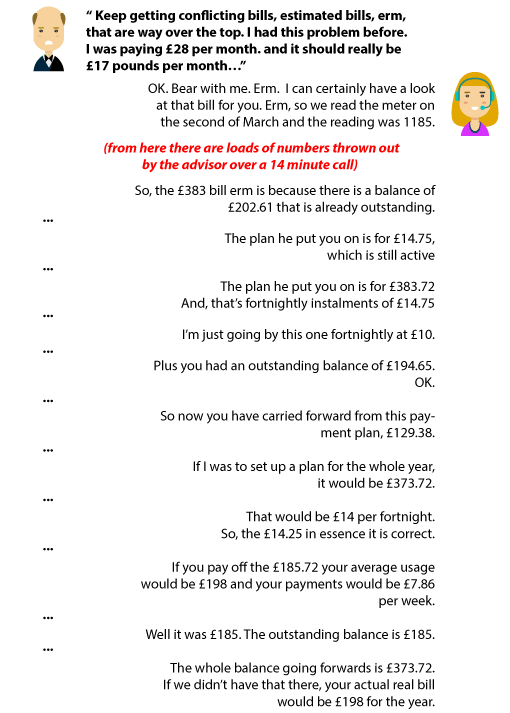

Consider this interaction, again taken from a genuine interaction recorded by a water company, as an example of how over-sharing can confuse and consequently frustrate the customer.

Clear as mud, right? Contact centres with a billing function may wish to check that their advisors do not have too great a fondness for numbers, which can be pushed onto customers. This is something academics call ‘the curse of knowledge’, and it can be a huge customer turn-off.

By contrast, in the same organisation as in the example above, there was one standout call handler who intuitively chunked up all the numbers to make it simple for the customers.

In a similar situation to the above, the advisor in question simply explained that: “If we got rid all of the debt you would be paying £15 per month; but because of the debt you need to pay £30 per month for the next year”.

This behaviour has become known as ‘ABC accounting’ and, when implemented across all 60 people in the billing team, CSat improved by 29.6% and billing complaints dropped by 14.2%.

Too Much Information Is a Widespread Issue

When working with this UK water company, Blue Sky found that that the ‘curse of knowledge’ isn’t related purely to the billing division. Across the organisation, field engineers and customer service advisors were baffling customers with TMI (Too Much Information).

If 100 advisors are asked whether they flex their style to suit the customer, almost 100 of them would likely shoot their hands up in the air. But if the advisors are asked exactly how they tailor the information given to customers, blank looks will likely be the result.

While the contact centre may have motivational posters dotted around, recommending advisors to “Be a chamaeleon”, “Flex your style” or “Tailor your approach”, rarely do advisors understand what this means in practice.

How Can Contact Centres Prevent Advisors From Falling Into These Habits?

The simple answer is: we need to update the way we train our sales and service staff, and be very clear about which behaviours must be avoided at all costs.

While many contact centres have a ‘call quality’ team that listens to calls, they are almost exclusively focused on monitoring procedural adherence and legal compliance. Team leaders pass on what they themselves learnt in their own inductions and on the phones and so perpetuate damaging behaviours.

Andrew Moorhouse

How much more effective would it be if organisations analysed their calls to identify what their top performers do differently and then fed this back into training?

Don’t be evasive. Don’t be inflexible. Don’t be vague about timescales. And don’t over-share.

These four rules won’t necessarily transform your organisation overnight – customer relationships are more complex than that. But, if ignored, these habits may start creeping their way onto the contact centre floor.

For more on quality issues in the contact centre, visit: The Quality Problem: Good Advisors Stay Good – Average Advisors Stay Average

Thanks to Andrew Moorhouse at Blue Sky

Are there any other habits that you would add to our list?

Please share your thoughts in an email to Call Centre Helper.

Author: Robyn Coppell

Published On: 22nd Jan 2018 - Last modified: 14th Aug 2025

Read more about - Customer Service Strategy, Angry Customers, Handling Customers, Service Strategy