In this article we look at how to measure and calculate customer churn rates in the contact centre.

What Is Customer Churn Rate?

Customer churn rate refers to the percentage of customers who end their relationship with a business within a given period.

In general usage, churn rate is also known as “attrition”, although within the contact centre industry, attrition tends to refer to staff loss rather than customer loss.

Customer churn rate can most readily be applied to subscriber-based service models where the number of active customers is easily quantified. However, non-subscriber businesses can still evaluate churn rate, but only as a net value rather than a gross value.

The Customer Churn Formula

Customer churn is ordinarily calculated as a gross value, using the formula below.

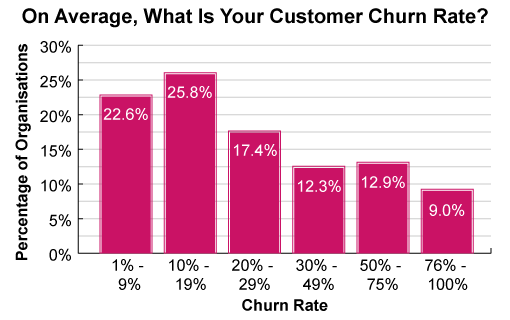

Gross customer churn is the traditional method of measuring customer churn and, through this method, the average churn rate organisations calculate is 20%, according to our 2016 survey.

These results come from our report: How Contact Centres Are Delivering Exceptional Customer Service (2016 Edition)

But the tricky part of using this equation is to decide upon a certain time period, with many organisations choosing to calculate yearly rates. However, it can be good to measure customer churn over a shorter time period as well.

Simon Priestly

Simon Priestley, an Interim Contact Centre Senior Manager, explains: “I would also take a shorter time frame and analyse it, to get a feel for whether or not your strategies to reduce churn are making a difference. You don’t want to spend time optimising processes, only to find out that, at the end of the year, you haven’t really made much of a difference to churn.”

“Measuring customer churn year-on-year is still important because lots of contact-based industries are seasonal. So, comparing where you are now to where you were 12 months ago is a great indicator of performance as it allows for industry factors that could change in-year.”

For less seasonal industries, measuring churn on a weekly rolling basis can also be very insightful. What we mean by this is measuring churn over the course of the year every week, with the oldest week dropping off when the latest week is included in the calculations.

By doing this, you can track longer-term trends to highlight systematic issues, find the exact week when the trend started to occur, providing insight which will help you to find the root cause of the churn.

What Is the Value of Calculating Customer Churn?

Here are two key benefits of measuring customer churn, which can help to inform your contact centre strategy.

1. Customer Churn Rate Enables You to Calculate Lifetime Value

Churn rate is a measure of a business’s current performance, but it can also be used to gain an understanding of longer-term performance.

“Average customer life time” is a metric that can be extrapolated from churn, and it indicates the length of time a customer is likely to remain with a business.

If (gross) churn for a year is 20%, it is understood that one fifth of the existing customer base ‘churned’ in that time. So, if 20% is a steady churn rate over time, then we are able to anticipate that, after five years, the company’s pool of customers will have been replenished.

If 20% is a steady churn rate over time, then we are able to anticipate that, after five years, the company’s pool of customers will have been replenished.

As such, in this example, we can calculate the average customer lifetime value to be five years – which is the first step in calculate customer lifetime value.

For more about measuring customer value, read our article: How to Calculate Customer Lifetime Value – The Formula

2. Customer Churn Rate Allows You to Measure Business Performance

Finding insight into why customers might be leaving is important in terms of customer retention, as identifying issues that are decreasing revenue is key for any organisation.

There’s great value in finding patterns in when customers leave to help identify what their reasons may have been.

Simon adds: “There’s a management principle which is that you can’t manage what you don’t measure, and there’s a lot of research that shows retaining customers is more cost effective than acquiring new ones. So, there’s great value in finding patterns in when customers leave to help identify what their reasons may have been.”

Simon’s point emphasises the importance for a brand to track how many customers they are churning in comparison to how many they recruit, in order to gain an overview of the organisation’s overall performance.

To gain such an overview, many organisations choose to measure net customer churn in addition to gross customer churn, in the hope of better informing their business strategy.

Calculating Net Churn Rate

To calculate net churn, you use a similar formula as when you calculate gross customer churn, except the value of “customers lost in this period” is reduced by the number of customers gained over the same period.

So, if you want to calculate net customer churn you should use the formula below:

As an example of how to use this formula, consider the net and gross churn rates of a small, subscription-based company, which records the following results:

| No. of Customers | |

|---|---|

| Customers at the start of period | 2,200 |

| Existing customers lost | 416 |

| New customers gained | 403 |

As this example shows, there can be a substantial difference between net and gross churn rate, with each saying something different about the business’s performance.

While the total number of customers in this example has reduced by less than 1%, almost a fifth of the existing customer base has chosen to leave.

This information can be important for business planners when allocating resources, as calculating both net and gross churn helps to inform planners whether they should prioritise attracting new customers or retaining existing customers.

Net Customer Churn Can Dip Below 0%

Because the number of customers gained can be greater than the number of customers lost, net churn can also be a negative value.

Gross churn, however, could not sink below zero because zero gross churn would indicate that the organisation has no customers had left.

However, the general principle is the lower your customer churn rate gets, the better the result for your organisation.

Calculating Separate Churn Rates for Different Products/Services

Once you understand your overall churn rate (gross or net), you need to start drilling into that.

So, how does churn vary by product or product group? And by customer demographic as well?

To find out, calculate individual churn rates across each of your product groups and different sections of your customer base too, in terms of age, channel preference and different behaviours, for example.

Simon, who is an advocate for doing this, says: “Splitting your churn rate across different product groups and customer demographics where possible is often the foundation for better analysis and customer research, which enables you to understand where you’re losing customers.”

“Then, you build on that by finding out why there is such a variance in churn rate, whether that’s through competitor activity, a poor customer experience or so on.”

Splitting your churn rate across different product groups and customer demographics is often the foundation of business analysis and customer research.

Once you have identified the products/services which have the highest rates of customer churn, look into the customer journeys that your customers go on to purchase these products, looking to find frictions and add value. This will help to limit churn in the most volatile areas.

Do the same with customer demographics, creating a persona of this demographic and following your customer journey through the eyes of this customer type.

For more on improving customer journeys, read our article: How to Reduce Friction and Add Rewards to the Customer Experience

Calculating Churn Rates for Down-Valued Customers

In some situations, it is useful to split churn into actual lost customers and down-valued customers as well, because a customer may still be a customer but they can slash their spend considerably.

As Simon says: “Pure churn measures whether or not the customer has gone, but there are customers who downgrade contracts, and that erodes your margin. And if you’ve made offers to retain customers for a while, hanging onto them longer term could be unprofitable unless you can build their value back.”

So, calculating rates for customers who down-value contracts can be interesting, in order to assess the severity of the problem in terms of value lost for your organisation.

Calculating rates for customers who down-value contracts can be interesting, in order to assess the severity of the problem in terms of value lost for your organisation.

If this is a regular problem, target these customers for feedback.

Perhaps you can put together a focus group to highlight why they made the decision to stop spending so much money with you.

If you then act on this feedback and treat these customers kindly, you may help to secure their continued business or even motivate them to upgrade the package to their previous agreement.

What to Watch Out For

Taking all of this into account, here are three mistakes that contact centres need to avoid when calculating churn rate:

Only calculating an annual figure for churn – It’s often a waste of time to measure things that aren’t actionable, and it’s hard to gain any actionable insight from yearly figures. Calculating churn over a shorter period will give you much better insight into the impact of your retention strategies – just be wary of the natural seasonality of customer churn.

Only calculating gross and not net churn – The impact of churn can only be truly assessed if you can gain an overview of how many customers you are “picking-up” alongside it. Looking at these two metrics side-by-side will be very useful in determining if your focus should lean towards acquiring or retaining customers.

Failing to break down churn across product groups and customer types – By splitting churn over these two areas, you can see the product groups and customer types in which you have the poorest levels of retention. Asking yourself why will allow you to focus your strategy on the areas in which you can make the most difference.

4 Tips to Reduce Customer Churn

While there are many strategies to reducing customer churn, here are three key examples that Simon recommends, followed by a bonus fourth for all of you artificial intelligence (AI) enthusiasts.

1. Shift Customers Onto Voice in the Last Six Weeks of Their Contract

While many organisations like to push customers towards self-serve to minimise operational costs, some companies do the opposite when the customer comes towards the end of their subscription or contract.

Simon says: “When customers are at risk of churning, some organisations see great benefit in having a human conversation with them.”

If a customer has been with you for 16 or 18 months and you’ve never spoken to them… you could drop them through to an advisor who can handle that manually for them.

“If a customer has been with you for 16 or 18 months and you’ve never spoken to them, but you pick up on them in a self-serve system, subject to capacity, you could drop them through to an advisor who can handle that manually for them. This gives you the chance to have open dialogue with them about renewing their tariff or developing their custom.”

In the contact centre, the voice channel is known to generate the highest levels of customer satisfaction, so this can be a great tactic to retain an at-risk customer. It’s just important to make sure that this channel shift is easy and painless.

2. Offer a Countdown Promotion

You can offer a “countdown promotion” so that when the customer reaches a certain time before their existing contract comes to a close, you can improve your chance of retention.

But remember, don’t tell the customer that you’re offering a discount for this reason, as they may come to expect a discount when their next contract comes up for renewal.

Customers like to feel special and that they’re getting a personalised deal. So, offering an unexpected discount which is easy to redeem will hopefully spur them on to renew.

However, Simon does offer a warning for doing this, saying: “In regulated industries, it can go against regulations to offer certain deals – for example your best available tariff might have to be available on your website – but there are still creative ways to reward loyalty. This includes industries such as banking an utilities.”

3. Look at Complaint Levels Alongside Customer Churn

Many organisations will find opportunities for customer retention by identifying moments of low customer satisfaction along the customer journey. This can be good practice, but it’s also important to assess churn in regard to complaints.

As Simon says: “When you look at customer complaint levels, you can find big hints as to where you are creating customer dissatisfaction – certainly for repeat complaint reasons.”

When you look at customer complaint levels, you can find big hints as to where you are creating customer dissatisfaction – certainly for repeat complaint reasons.

By looking at repeat complaint reasons and assessing the related product group and demographics from which the customer complaints were from, you may be able to add context to your churn rates and identify specific areas in which to improve.

4. Use AI to Predict Customer Behaviour

One final retention strategy to reduce churn is to use AI to aggregate customer information – such as their buying history, contact history and survey responses – to predict future behaviour.

One such prediction is the likelihood of churn, and if you can send out a proactive message to engage with that customer before they do so, you can help to recapture their attention and maybe their business.

Thomas Hebner

Discussing this strategy, Thomas Hebner – Head of Product Innovation, Voice Technology and AI at Nuance Communications – says: “When you’re talking to a bank, they’ll know everything about you, and they should! So, with AI, these companies can use all of this data to understand what the customer is likely contacting them about.”

“This means that advisors get better context for why customers are calling, but it also means that you can track signals that a customer may be about to stop doing business with you. Then, you can use predictive notifications, relevant to the customer’s journey, and draw them back in.”

You can also use AI-based call routing to pass at-risk and other customers through to the advisor who is predicted to be the best “fit” for them, based on estimated customer satisfaction scores – taken from analysis of customer and advisor data.

For advice on reducing churn through creating stronger customer relationships, read our article: What Is Stopping You From Creating Great Customer Relationships?

In Summary

When you calculate how many customers stop doing business with you over a certain period, this is known as gross customer churn.

This can be a great metric to calculate over monthly periods, to gain an overview of the impact of your retention strategies, assess customer lifetime value and evaluate overall business performance.

To gain further insight into calculating business performance, you should also calculate net customer churn. This is when you calculate churn in respect to the number of customers that you take on as well.

By comparing these two metrics, you will gain more insight into whether your organisational strategy should be focused more on acquiring or retaining customers.

If you find that you should be more focused on customer retention, you can gain useful insights from your churn calculations, by splitting the measure across product groups, customer demographics and by calculating a churn rate for down-valued customers. This will help to show you where you can make the biggest “retention gains” and reduce churn.

In these areas, you can employ tactics such as shifting at-risk customers to voice, offering countdown promotions and using a proactive strategy.

For more on measuring common contact centre metrics, read the following articles:

- How to Calculate Attrition Rate – the Formula

- How to Calculate Occupancy

- How to Calculate a Customer Satisfaction Score (CSAT)

Author: Jonty Pearce

Published On: 29th May 2019 - Last modified: 13th Aug 2025

Read more about - Workforce Planning, Attrition, Customer Loyalty, Editor's Picks, How to Calculate, Metrics, Nuance, Workforce Planning