Indecisive customers are a common challenge in the fast-paced world of contact centres, they can slow down conversations, extend handling times, and frustrate even the best contact centre advisors.

Whether they’re unsure about a product or hesitant to commit, their uncertainty makes it harder to deliver efficient service.

In this article, we share practical techniques to help advisors guide customers toward confident decisions, without adding pressure or complexity.

What Does an Indecisive Customer Look Like?

As implied in the name, an indecisive customer just cannot make a decision. As a consequence, they ask lots of questions and/or keep switching between different options.

Not only can these conversations ramp up handling times, but they can also be tricky to deal with, especially if the advisor struggles to take control of the conversation.

Indecisive customers are commonly encountered in sales, where strong objection handling skills can play a key role in helping customers overcome their hesitation and reach a decision.

7 Ways to Deal With An Indecisive Customer

But let’s focus more on customer service and consider: how can advisors match the right customer to the right solution, while providing complete peace of mind?

1. Classify the Customer’s Key Objectives

When dealing with an indecisive customer, an advisor needs to keep a strong focus on the customer’s ideal end goal.

To reach this goal, advisors must consider whether or not they understand a customer’s decision-making criteria. In other words, do they know what the customer’s main objectives are?

According to Caroline Cooper, customers will normally have a preference for one of the following three things: quality, cost/investment or time. It can be useful for advisors to identify which is the customer’s biggest priority.

If an advisor is unsure of the customer’s key objectives, asking open questions will help to unlock these insights and gather lots of helpful information.

2. Ask Open Questions to Gather Information

Straightforward questions like the following are powerful in classifying a customer’s key objectives:

- What was your main motivation for calling?

- Which features are important to you?

- What is it that you are looking for?

It is easy to use open questions, as advisors simply need to remember to start with the words: “who”, “what”, “when”, “where and “how”. These questions encourage the customer to provide a detailed response.

Whereas questions that begin with “is”, or more commonly “do” or “don’t”, are closed questions. This means that the customer can only answer “yes” or “no”.

“Remember that ‘D’ – for “do” and “don’t” – closes the door. Think with a “W” to open it up,” says Nancy Friedman, Founder of Telephone Doctor.

“Also, try not to barrage a customer with lots of questions, one after the other. At least, tell the customer beforehand that you have a few questions to ask them.”

By setting up questions with a statement like: “In order for me to be of value and help you, I have four or five questions to ask you”, this will ensure that the customer feels comfortable and not as if they’re under interrogation.

Alongside asking open questions, use active listening to understand the customer’s main objectives – paying close attention to tone and language selection. Then, the advisor can start to use probing questions to get to the heart of the matter.

For more information on open questions (and examples you can use), read our article: Open Questions to Use in Customer Service

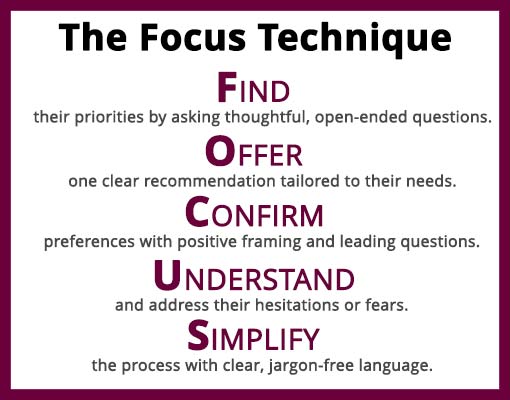

3. Use the FOCUS Technique

When dealing with indecisive customers, a clear structure like the FOCUS technique can help advisors guide them towards a confident decision.

There are five steps to the FOCUS technique:

- Find their priorities by asking thoughtful, open-ended questions.

- Offer one clear recommendation tailored to their needs.

- Confirm preferences with positive framing and leading questions.

- Understand and address their hesitations or fears.

- Simplify the process with clear, jargon-free language.

Using the FOCUS technique helps to keep conversations on track and provides a clear way to support indecisive customers while making the decision process as simple as possible.

Here’s how each step works in practice:

Find Their Priorities

You need to determine the customer’s primary objective (e.g., speed, quality, cost) to align solutions with their needs.

To do this start by asking open-ended questions to understand what matters most to the customer. For instance, “What’s the most important thing for you?” or “What are you hoping to achieve?” This will help you uncover whether their main focus is cost, quality, or something else.

You also need to listen for cues in their tone, language, and hesitations to uncover unspoken priorities.

Example

Customer: “I’m torn because I like Option A’s features, but Option B is cheaper.”

Advisor: “It sounds like both value and cost are important to you. Let’s explore which one aligns better with your situation.”

Offer One Clear Recommendation

Then you need to simplify the decision-making process by reducing choice overload, which often causes indecision.

Once you know their priorities, suggest one solution that fits their needs. For example, “Based on what you’ve said, I’d recommend this option because it meets your main requirement for…”

Keep a backup option ready (Plan B) but only introduce it if the customer remains uncertain.

Example

Advisor: “Based on what you’ve told me, I recommend Option A because it meets your delivery speed and performance requirements. If you’d like, I can also show you how it compares to other options.”

Confirm Preferences

Next you need to build momentum by encouraging the customer to agree with your solution through subtle affirmation techniques.

Use leading questions to nudge them toward a confident decision and focus on framing the recommendation positively to encourage a “yes” response.

You can check that the customer agrees with your suggestion by using simple, positive questions. You might say, “Does this sound like the right option for you?” or “Does this meet your needs?” This can help them feel more confident about the choice.

Example

Advisor: “This plan includes everything you mentioned: affordable pricing and next-day delivery. Does that sound like a good fit for you?”

Understand and Address Hesitations

Then you need to address the root causes of their indecision, such as fear of making the wrong choice or lack of information.

If the customer is still unsure, ask questions like, “Is there anything you’re unsure about?” Listen carefully and provide reassurance or further information. For example, “Many customers with the same concern have found this option works well because…”

You can also offer solutions to minimize their perceived risks, such as guarantees, reviews, or trials.

Example

Customer: “I’m worried about committing without seeing it in action.”

Advisor: “I completely understand. How about I send you a demo video to see how it works?”

Simplify the Process

Finally you need to ensure the customer feels informed and in control by communicating clearly and avoiding industry jargon.

Keep the conversation clear and straightforward. Avoid technical terms, overloading the customer with details, and phrases that might sound dismissive, like “It’s company policy”.

Explain what happens next in a way that’s easy to follow. “The next step is simply to…”

Example

Instead of: “Our premium package offers a multi-channel, omnichannel communication suite for enterprise use.”

Say: “Our premium package allows you to manage all customer interactions—like emails and calls—in one simple dashboard.”

Discover lots more interesting questioning techniques for the contact centre by reading our article: 10 Effective Questioning and Probing Techniques for Customer Service

4. Offer Reassurance to Customers

By asking lots of questions and leading the call an advisor can take ownership of the conversation. However, for a customer to have full faith in the advisor, reassurance is important.

The customer should be reassured in two ways:

- That the advisor knows their stuff

- That the advisor cares about their issue

If an advisor manages to reassure the customer of both of these, the customer will be much more likely to listen to their advice and make a decision.

Let’s take the first point. Using a couple of reassurance statements – just like those below – the advisor can position themselves as an expert.

- “I recently spoke with a customer who had exactly the same concerns are you do. We decided to go with Option A because…”

- “I personally love this product because it…”

The first statement shows that the advisor is experienced in handling issues of this nature. The second allows the advisor to demonstrate their product knowledge, while reiterating the benefits of the products.

In terms of reassuring the customer that they care about their problem, it can be best practice for an advisor to use empathy statements, just like the following:

- “I can certainly see why this is tricky for you, Mr. Smith. Let’s work together to find the right solution.”

- “I understand that this is an important decision. Fortunately, you’ve called the right place…”

These statements are great for advisors to show customers that they are on their side, while they also help to build rapport, which is important for a positive conversation.

5. Ask Advisors to Keep Plan B in Their Back Pocket

Customers can be indecisive when they have more than one option to choose from.

Yet if the advisor only presents them with one option in the first place, they remove a potential source of indecision.

“If you give a customer two options, that can be confusing. I wouldn’t give two, I would have plan B in my back pocket, just in case a customer asks for something else.” – Nancy Friedman

Also, by giving two options, you may be giving away everything that you have got – which can lead to an awkward pause if the customer asks for alternatives.

So, figure out the customer’s main motivations for calling before presenting options to them. Then, the advisor can present the solution that they think best suits the customer’s needs.

If the customer would like to hear alternative options, the advisor can then fall back on “option b”, before telling the customer why they believe that “option a” is better suited to them.

For more on the topic of presenting options to customers, read our article: Call Control Techniques: How to Present Options to Customers

6. Build Advisor Empowerment to Uncover Fear Factors

Indecisive customers are often worried about making the wrong decision. So contact centres may also need to think about how they can reduce any associated risks.

Offering anything from tips sheets to demos or maybe even a trial period can help to remove uncertainty for customers.

Of course, advisors need to be empowered to provide these options, while it is also good to consider what is causing the “fear factor” for each customer. This “fear factor” is the “delay reason” that is preventing the customer from making a decision.

If advisors are allowed to venture off-script and use various questioning techniques to decipher what the customer’s delay reason really is, their chances of handling the call successfully greatly increase.

“Scripts are for actors. Bullet points and visual guides are great tools for advisor support, but an advisor should not be constrained by sticking to a script.” – Nancy Friedman

To provide great customer service, contact centres must often go beyond the confines of a script and perhaps talk to their colleagues about how else they can best serve the customer.

Nurturing a collaborative “network judgement” culture is great for this. To create such a culture, read our article: What Is the Best Model for Contact Centre Culture?

7. Avoid Phrases That Cause Customer Confusion

Indecision can be a result of customer confusion. Good call control skills will minimize this issue and keep the conversation on track.

However, the language that an advisor uses can also be confusing. A few classic contact centre examples include:

- “It’s company policy” – This does not answer the customer’s question, leaving them confused. It may also lead to awkward dead air time.

- “Can I take your Christian name please?” – Many people will not understand that a Christian name means somebody’s first name. This phrase may also be considered by some as culturally inappropriate and can break rapport. Instead say “Can I take your first name please?”

- “We don’t deal with that” – While this may be true, it is a terrible way of wording it, as it makes the customer feel as though they are a burden. It may also be confusing, as the advisor is supposed to represent the company that the advisor is calling, so should at least have some advice.

By being aware of how these statements impact customers, advisors can be coached to use better alternatives.

For example, the three phrases below can replace those that are bullet-pointed above:

- “That option is not possible because… But, what I can do for you is…”

- “Can I take your first name please?”

- “It sounds like you need our X department. I will transfer you to them right away.”

If your agents can keep conversations clear and use simple language, customers will know exactly what to expect. Hesitancy then becomes much less of a problem.

Uncover lots more confusing phrases to avoid in customer service by reading our article: 15 Things a Call Centre Agent Should Never Say (But Many Do)

What to Say to An Indecisive Customer

The right words, delivered with clear and supportive communication, can help customers feel understood, build trust, and guide them toward confident decisions.

So lets take a look at a few phrases advisors can say to indecisive customers at specific points in the conversation:

Clarifying Priorities

Helping a customer clarify what matters most—such as cost, quality, or speed—provides a foundation for decision-making. Advisors should ask open-ended questions to uncover priorities without overwhelming the customer.

Here are a few phrases an agent can use to clarify a customers priorities:

- “Can you tell me what’s most important to you when choosing this option?”

- “Let’s narrow this down. What’s your main priority right now?”

- “What would make this the right choice for you?”

Identifying Specific Concerns

By understanding what is causing hesitation, advisors can address the root of the indecision. This involves active listening and asking follow-up questions to explore underlying doubts or uncertainties.

Below are a few examples of what an advisor might say to identify specific concerns a customer may have:

- “Is there a particular feature or detail that’s making it hard to decide?”

- “What concerns do you have about this option? Let’s tackle those together.”

- “I understand this feels like a lot to choose from. What’s holding you back right now?”

- “If we could address [specific worry], would this option work for you?”

Providing Guidance and Recommendations

Offering one well-suited option simplifies the decision-making process. Advisors should explain how the recommended solution meets the customer’s needs, avoiding unnecessary complexity or alternatives that could confuse.

Here are some practical examples of language an agent can use to provide guidance and recommendations:

- “Based on what you’ve told me, I think [Option A] is a good fit for you.”

- “I’ve helped many customers in a similar situation, and they found [Solution] worked really well for them.”

- “I think [Option A] would be the best fit. Let me know if you’d like to explore another one.”

- “I can walk you through the options so you can decide which one works best.”

Offering Reassurance and Confidence

Reassuring customers that their concerns are understood and that the recommended solution is reliable builds confidence. Advisors can share relevant examples or demonstrate expertise to establish trust.

Here are some helpful phrases an advisor can use to offer reassurance and build confidence:

- “Let’s focus on narrowing down what’s most important to eliminate any doubts.”

- “I want to make sure you’re comfortable with your choice, so let’s go over the details to make sure it’s right for you.”

- “Would a demo/trial/review help you feel more confident about this decision?”

Printable – 14 Statements to Use With Indecisive Customers

Do you want to download this to share with your team?

Get your free download of 14 Statements to Use With Indecisive Customers now:

Find lots more great advice for handling tricky customer contacts by reading our articles:

Author: Charlie Mitchell

Reviewed by: Robyn Coppell

Published On: 11th Aug 2021 - Last modified: 6th Jan 2026

Read more about - Skills, Call Handling, Caroline Cooper, Charlie Mitchell, Customer Service, Empowering Agents, Handling Customers, Nancy Friedman, Skill Development